Regulations for Listed Local Businesses

Running a local business can be a rewarding endeavor, but it also comes with a set of regulations that must be followed. These regulations are put in place to ensure fair competition, protect consumers, and maintain the integrity of the local business ecosystem. In this article, we will explore the various regulations that listed local businesses need to adhere to, and how they can navigate these requirements to thrive in their respective industries.

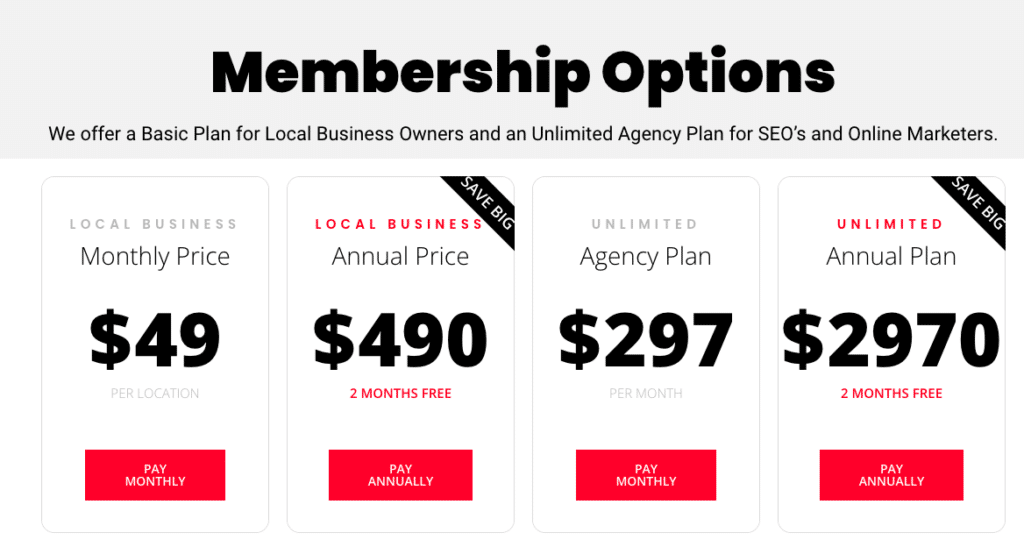

Get a 14-DAY FREE TRIAL for 300 Local Citations you can edit on one simple dashboard.

1. Licensing and Permits

One of the first and most important regulations that listed local businesses must comply with is obtaining the necessary licenses and permits. These requirements vary depending on the type of business and the location, but they are essential for operating legally and avoiding potential fines or penalties.

For example, a restaurant may need to obtain a food service license, while a construction company may require a building permit. It is crucial for local businesses to research and understand the specific licensing and permit requirements for their industry and location.

Failure to obtain the necessary licenses and permits can result in legal consequences, such as fines or even closure of the business. It is advisable for local businesses to consult with legal professionals or regulatory agencies to ensure compliance with all applicable regulations.

Get a 14-DAY FREE TRIAL for 300 Local Citations you can edit on one simple dashboard.

2. Tax Obligations

Another important aspect of regulations for listed local businesses is tax obligations. Local businesses are required to pay various taxes, including income tax, sales tax, and payroll tax, among others. Failure to meet these tax obligations can lead to severe financial and legal consequences.

Get your FREE 14 DAY TRIAL for over 300 local citations. Click below!

Local businesses should keep accurate records of their income and expenses, and ensure that they are filing their tax returns correctly and on time. It is also essential to stay updated on any changes in tax laws or regulations that may affect the business.

Utilizing the services of a professional accountant or tax advisor can be beneficial for local businesses, as they can provide guidance on tax planning, deductions, and other strategies to minimize tax liabilities while remaining compliant with regulations.

Get a 14-DAY FREE TRIAL for 300 Local Citations you can edit on one simple dashboard.

3. Employment Laws

When it comes to hiring employees, local businesses must also comply with various employment laws and regulations. These laws govern areas such as minimum wage, overtime pay, workplace safety, and anti-discrimination practices.

For example, the Fair Labor Standards Act (FLSA) sets the federal minimum wage and overtime pay requirements. Local businesses must ensure that they are paying their employees at least the minimum wage and providing appropriate compensation for overtime work.

Additionally, local businesses must create a safe and inclusive work environment, free from discrimination and harassment. They should have policies and procedures in place to address any complaints or issues that may arise.

Get a 14-DAY FREE TRIAL for 300 Local Citations you can edit on one simple dashboard.

Staying informed about changes in employment laws and regularly reviewing and updating employment policies can help local businesses avoid legal disputes and maintain a positive work environment.

4. Advertising and Marketing Regulations

Local businesses must also adhere to regulations regarding advertising and marketing practices. These regulations are in place to protect consumers from false or misleading information and ensure fair competition among businesses.

For example, the Federal Trade Commission (FTC) regulates advertising practices in the United States and prohibits deceptive or unfair advertising. Local businesses should avoid making false claims or using misleading tactics in their advertising campaigns.

It is also important for local businesses to comply with any industry-specific regulations regarding advertising and marketing. For instance, the pharmaceutical industry has strict regulations on the promotion of prescription drugs.

Get a 14-DAY FREE TRIAL for 300 Local Citations you can edit on one simple dashboard.

By understanding and following these regulations, local businesses can build trust with their customers and avoid potential legal issues.

5. Environmental Regulations

Environmental regulations are another important aspect of compliance for listed local businesses. These regulations aim to protect the environment and ensure sustainable practices in various industries.

Local businesses should be aware of any environmental regulations that apply to their operations, such as waste management, emissions control, or water usage restrictions. Failure to comply with these regulations can result in fines, legal action, and damage to the business’s reputation.

Implementing environmentally friendly practices not only helps local businesses meet regulatory requirements but also demonstrates their commitment to sustainability, which can attract environmentally conscious customers and enhance their brand image.

6. Case Study: The Impact of Regulations on Local Restaurants

Local restaurants are a prime example of how regulations can significantly impact businesses. From licensing and permits to health and safety regulations, restaurants must navigate a complex web of requirements to operate legally.

Get a 14-DAY FREE TRIAL for 300 Local Citations you can edit on one simple dashboard.

For instance, a local restaurant in New York City must obtain a food service establishment permit, a liquor license if they serve alcohol, and comply with health and safety regulations set by the Department of Health.

These regulations ensure that restaurants meet certain standards of cleanliness, food handling, and overall safety. While these requirements may seem burdensome, they are crucial for protecting public health and maintaining consumer trust.

Restaurants that fail to comply with these regulations can face fines, closure, or damage to their reputation. On the other hand, restaurants that prioritize compliance and maintain high standards can attract more customers and build a loyal customer base.

Get a 14-DAY FREE TRIAL for 300 Local Citations you can edit on one simple dashboard.

Regulations for listed local businesses are in place to ensure fair competition, protect consumers, and maintain the integrity of various industries. From licensing and permits to tax obligations, employment laws, advertising regulations, and environmental requirements, local businesses must navigate a complex landscape of regulations to operate legally and successfully.

By understanding and complying with these regulations, local businesses can avoid legal consequences, build trust with customers, and create a positive work environment. Seeking professional advice, staying informed about changes in regulations, and implementing best practices can help local businesses thrive in their respective industries.

Remember, compliance with regulations is not only a legal requirement but also an opportunity to demonstrate professionalism, integrity, and commitment to the community. Citation Vault, a local citation service that automates 300 local citations for any business, can assist local businesses in maintaining accurate and up-to-date information across various online platforms, further enhancing their compliance efforts.

Learn more about “Local Business Listing Services” here.

Frequently Asked Questions About Regulations for Listed Local Businesses

What Are the Key Legal Regulations Affecting Listed Local Businesses?

Legal regulations affecting local businesses can vary by jurisdiction, industry, and type of business. However, there are common threads that most businesses need to consider.

First, businesses often need to secure necessary permits and licenses to operate, which may involve zoning laws, health and safety standards, and professional accreditation.

Second, compliance with federal, state, or local tax codes is a must, including proper documentation and timely filing.

Third, businesses should adhere to employment laws, including minimum wages, workplace safety, and employee rights. Intellectual property, data protection, and consumer rights are other areas that often fall under regulatory scrutiny. Non-compliance can lead to severe penalties, loss of license, or even the closure of the business.

How Important Is NAP Consistency in Local Listings?

Name, Address, and Phone number (NAP) consistency is crucial in the realm of local listings. Inconsistent NAP information can not only confuse potential customers but can also adversely affect your search engine rankings. Search engines use NAP information as a factor to determine the legitimacy and credibility of a business. Consistent NAP across all listing platforms, social media, and your website ensures higher visibility and can contribute to higher search rankings. Regulatory compliance also dictates that your business information must be accurate and transparent, failing which, you may be subjected to penalties or legal challenges.

Are There Specific Regulations for Online Reviews and Testimonials?

Absolutely, the Federal Trade Commission (FTC) in the United States, and similar bodies in other jurisdictions, regulate online reviews and testimonials. Businesses are not allowed to post fake reviews or offer incentives for reviews unless this is clearly disclosed. Any relationship between the reviewer and the business must also be disclosed. This is not just good ethical practice but also necessary for regulatory compliance. Non-adherence to these regulations can result in severe fines and damage to your business reputation.

What Legal Considerations Should I Bear in Mind When Using Local Business Schema Markup?

Schema markup helps search engines understand specific information about your business, like services offered, ratings, and operational hours. While this is beneficial for SEO, it’s crucial to ensure that the information you present is accurate and up-to-date, not just for SEO benefits but also for regulatory compliance. False or misleading information can put you at odds with consumer protection laws. Furthermore, Google and other search engines have guidelines that dictate what you can and cannot include in schema markup, and non-compliance may result in penalties including loss of search engine rankings.

Are There Regulations That Govern the Use of Local Business Logos and Trademarks?

Yes, the use of logos and trademarks is heavily regulated under intellectual property law. Unauthorized use of copyrighted or trademarked material can result in legal action and significant financial penalties. Ensure that you either own the rights to the logos and trademarks you use or have secured permission to use them. Moreover, your own business logo and trademark should be registered to protect your brand identity. Non-compliance not only puts you at legal risk but can also affect your local business listings if they are taken down due to violations.

Understanding the intricacies of regulations for listed local businesses is essential for both maintaining your local business listings and ensuring legal compliance. Failure to understand and adhere to these regulations can have both immediate and long-term detrimental impacts on your business.

- local business listings

- local canadian citations

- local citations

- Regulations for Listed Local Businesses